Hey Fintech Friends!

The August 2025 edition of FinWise Bank’s Insights Newsletter delivers a dynamic blend of industry insights, thought leadership, product innovation, and news-worthy updates. It explores the evolving landscape of stablecoins and Banking-as-a-Service (BaaS), drawing on contributions from senior leaders and real-world stories.

In particular, we cover:

- Building a High-Performing BaaS Operations Team.

- Stablecoins: Infrastructure or Intrusion?

- A Glimpse into the Future of Global Payments.

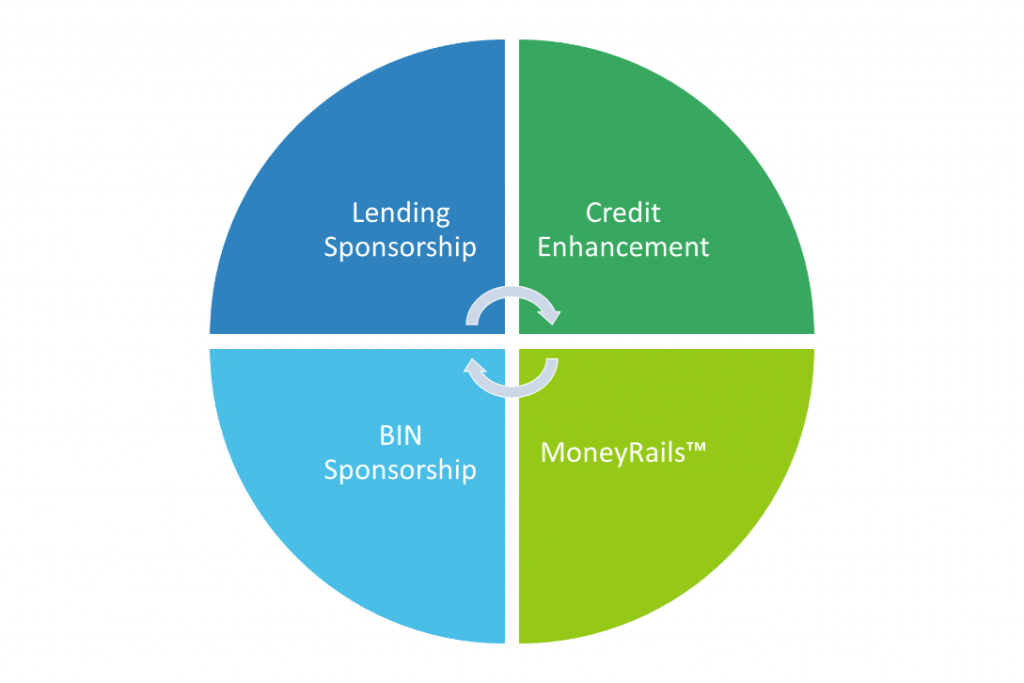

- Highlighting Four Fintech Programs: Lending Sponsorship, Credit Enhancement, BIN Sponsorship, and MoneyRails™.

- Fintech Partner Spotlight with Plannery.

Ready to Fly with FinWise? 🦉

News recap.

- Latest Podcast(s)

- Inside the World of Credit Modeling and Marketing with David Peterson from Elevate

- Navigating the Future of Stablecoins and Financial Regulations with Ben Jackson from Innovative Payments Association

- Are Stablecoins the Future of Financial Infrastructure? with Simon Taylor from Sardine

- Biometrics, Bots & Behavioral Clues: The Future of Fraud Detection, with Soups Ranjan from Sardine

- News from FinWise

We’re thrilled to announce that FinWise Bank won “Top Innovation in Banking” at the 2025 Banking Tech Awards USA for our groundbreaking payments hub, MoneyRails! MoneyRails is redefining payments by streamlining connections between fintechs and financial infrastructure – securely, compliantly, and efficiently. Huge thanks to our visionary team, partners, and clients who make innovation part of our DNA. The future of banking is being built here. Learn more about MoneyRails👉

Thought leadership.

Donnie Drake

SVP, BaaS Operations

at FinWise Bank

Building a High-Performing BaaS Operations Team

Why the right people, processes, and expertise matter more than ever.

As the Banking-as-a-Service (BaaS) model continues to evolve, sponsor banks are taking on a more strategic role—driving fintech innovation while upholding regulatory, reputational, and operational standards. But enabling that innovation starts with assembling the right team.

A high-performing BaaS Operations team is far more than a back-office function—it’s the vital link connecting fintech partners, payment networks, core banking systems, and compliance frameworks. For banks building or optimizing their BaaS programs, the operations team must be intentionally designed for this fast-paced, multi-payment rail environment.

There are some essential roles that serve as the foundation of a high-performing BaaS operations team. Forget the one-size-fits-all structure—Banking-as-a-Service demands specialists who understand the nuances of modern payments infrastructure and can collaborate seamlessly with both internal teams and external partners.

Laying the Foundation: Key Roles That Drive Success

One critical role is the Cards & Payment Network Specialist. This expert manages the day-to-day operations of card programs, ensuring smooth transaction processing and strict adherence to network rules and compliance standards. They act as the primary liaison between the bank, card processors, and major networks like Visa and Mastercard, playing a key role in maintaining performance and regulatory alignment.

Equally important is the ACH & Real-Time Payments Specialist, who handles escalated ACH origination issues, returns, and exceptions. With deep knowledge of NACHA rules and real-time payment systems like RTP and FedNow, this specialist ensures that all payment activity is compliant, efficient, and aligned with partner needs in a fast-moving environment.

The Relationship Manager brings a strategic, partner-facing perspective to the team. This seasoned leader owns the relationship between the bank and its fintech partners, ensuring that service-level agreements are met, issues are resolved quickly, and both parties are aligned on compliance and operational expectations. Their ability to balance partner satisfaction with regulatory responsibility is key to long-term success.

Finally, the BaaS Operations Manager provides the connective tissue across all payment flows. This individual understands how money moves—from origination to settlement—across ACH, FedNow, RTP, wires, and card networks. They translate partner needs into scalable operational solutions and drive continuous improvement across systems and workflows. Their blend of operational rigor and systems thinking is essential for building resilient, partner-centric infrastructure.

While these four roles form the operational backbone of a successful BaaS sponsorship, they’re just the beginning. Delivering a truly resilient and scalable BaaS program takes a company-wide effort. Teams across compliance, legal, deposit operations, BSA, Risk, and other fintech-focused functions all play essential roles in ensuring partnerships are not only innovative but also secure, compliant, and sustainable. It’s this cross-functional collaboration—rooted in shared goals and deep domain expertise—that transforms a strong foundation into a strategic advantage.

Strong Foundations, Smarter Execution

Assembling a strong BaaS Operations team is a critical first step—but the real differentiator lies in how that team functions day to day. The most effective teams don’t just execute—they elevate.

What sets them apart? First, they cultivate deep, rail-specific expertise. Each payment type—whether ACH, RTP, FedNow, or card networks—comes with its own unique workflows, file formats, and compliance requirements. That’s why training isn’t one-size-fits-all; it’s tailored to the nuances of each rail.

These teams also lead with a partner-first mindset. They take the time to understand each fintech’s product, risk profile, and customer journey—so they can design operational processes that truly fit, not just function.

Clear, accessible playbooks are another hallmark. The best teams ensure that documentation is not only thorough but easy to follow and consistently applied across the board.

And finally, high-performing BaaS Operations teams thrive on collaboration. They work hand-in-hand with implementation, compliance, legal, product, risk, and deposit operations—proactively managing the full lifecycle of fintech partnerships with agility and alignment.

Final Perspective: When Every Team Drives Strategy

A strong BaaS operations team doesn’t just “keep the lights on”—they create the conditions for responsible growth. In today’s sponsor banking environment, operational excellence with a compliance-first approach is what sets apart trusted bank-fintech partnerships from failed ones.

All in all, it would be remiss of me not to acknowledge that it truly takes a village to run a successful BaaS program across any organization. At the end of the day, every team member at FinWise Bank plays an integral role in the success of our programs.

Whether you’re entering the BaaS sponsorship arena for the first time or refining an existing strategy, start with the team. The rest will follow.

Invest in them. Train them. Structure them for growth.

They’re not just running systems—they’re powering your future.

Stablecoins: Infrastructure or Intrusion? What Financial Institutions Need to Know.

Sarah Grotta

Deputy Chief Fintech Officer

at FinWise Bank

It’s not every day that a new form of money walks into the halls of Washington and Wall Street at the same time.

Yet here we are. Stablecoins—those once-niche digital tokens designed to track the value of fiat currencies—are now front and center in the financial services conversation. In 2024, AI stole the headlines. Before that, Non-Fungible Tokens (NFTs), remember them? In 2025, the buzzword of the year is shaping up to be “stablecoin.” And this time, the hype comes with real-world implications for financial institutions, fintechs, and the global economy. It may surprise many that there are already Trillions of dollars being transacted in stablecoin today. Visa has a dashboard to track its use.

From Capitol Hill to the boardrooms of Fortune 500 companies, stablecoins are no longer a curiosity. They are fast becoming a pillar of next-generation payment infrastructure—and a potential competitor to traditional banking rails.

So what’s driving this momentum? And more importantly, what does it mean for banks like FinWise?

From Speculation to Stability

The core idea behind stablecoins is simple: create a digital token that retains a consistent value, typically pegged 1:1 to a fiat currency like the U.S. dollar. Unlike volatile cryptocurrencies such as Bitcoin, stablecoins are designed for utility—not speculation.

As Simon Taylor of Sardine put it in a recent FinWise Eye On podcast episode,

We didn’t have a digital version of cash before. Now we do—and it’s programmable, instant, and global.

What Changed?

Two things:

1. A LITTLE Regulatory Clarity Has Arrived (there are still a lot of unknowns that need to be worked out)

The bipartisan GENIUS Act, now law, establishes a comprehensive framework for stablecoin issuance in the U.S. Under Section 4, only approved entities—called permitted payment stablecoin issuers—may issue stablecoins. These issuers must:

- Maintain 1:1 reservesbacking all outstanding stablecoins, held in high-quality liquid assets such as U.S. currency, insured bank deposits, short-term Treasuries, and tokenized equivalents.

- Prohibit rehypothecationof reserves, except in limited, regulated scenarios.

- Disclose redemption policiesand publish monthly reserve breakdowns on their websites.

- Undergo monthly auditsby independent public accounting firms.

- Provide CEO and CFO certificationsto regulators affirming the accuracy of reserve reports.

- Comply with tailored capital, liquidity, cybersecurity, and risk management standards set by federal or state regulators

This level of oversight is designed to prevent the kind of liquidity crises that shook the digital asset space in recent years.

For more on the regulatory landscape, check out our Eye On podcast with Ben Jackson from the Innovative Payments Association.

2. Use Cases Have Gone Global.

Stablecoins are solving real problems in emerging markets where foreign exchange friction and banking infrastructure gaps persist. But they’re also being adopted quietly by multinationals managing complex treasury operations.

Will Stablecoins Replace Banks?

No—but they could disintermediate certain banking functions.

For example, if large retailers begin issuing their own stablecoins to customers and suppliers, they may create closed-loop ecosystems that avoid card networks and even ACH rails. That could mean less interchange revenue and fewer customer deposits for traditional banks.

Yet this shift also opens the door for bank-led innovation:

- Sponsor banks can support permitted stablecoin issuers, using their compliance infrastructure as a moat.

- Real-time fraud tools and BSA/AML frameworks can help manage on-chain risk with the same rigor as fiat rails.

- New products—like tokenized rewards, programmable money, and B2B payments—can be built directly on stablecoin rails.

The Roadblocks: Fragmentation and Trust

Two challenges remain:

- Interoperability: As more players launch their own stablecoins, converting between coins and chains adds complexity. Solving this requires the equivalent of a clearinghouse for stablecoins—an emerging role for fintech orchestrators.

- Consumer Trust: Will the average U.S. consumer adopt a Walmart Coin or an Amazon Dollar? That depends on education, convenience, and whether the experience is indistinguishable from current mobile wallets.

What Should Banks Do Now?

The time to observe is over. Stablecoins are already being used by businesses, embedded in fintech roadmaps, and—soon— endorsed by Congress through legislation providing guardrails for their use.

Banks that want to remain relevant must:

- Engage in pilot projects using trusted issuers.

- Update risk systems to monitor both on-chain and off-chain behavior.

- Explore partnerships with fintechs building stablecoin rails or clearing networks.

- Educate internal teams on stablecoin use cases, regulations, and fraud vectors.

Final Thought

Like any disruptive innovation, stablecoins are both a threat and an opportunity. The question is not whether they will change the financial landscape—but whether banks will help shape that change or be shaped by it.

At FinWise, we believe the answer starts with understanding the technology, embracing the regulatory clarity to come, and finding ways to innovate safely and responsibly.

The new payments rail is here. Let’s make sure it’s one we help build.

Sources:

– Genius Act Overview – U.S. Senate Committee on Banking, Housing, and Urban Affairs: https://www.banking.senate.gov/

– Circle’s Reserve Transparency Reports: https://www.circle.com/en/transparency

– Visa’s Stablecoin Strategy – CNBC Interview with CEO Ryan McInerney: https://www.cnbc.com/

– Sardine Fraud Risk Insights: https://www.sardine.ai/

– IMF on Global Stablecoin Adoption: https://www.imf.org/

🌍From Victoria Falls to Visa Direct: A Glimpse into the Future of Global Payments.

Desiree Sanchez

Director of Digital Marketing &

CRM Integration at FinWise Bank

Earlier this year, an exciting trip to Victoria Falls left me in a tight cashless spot. I’d hired a private driver to shuttle me from Zimbabwe to Zambia and back. After walking with lions, hanging off a waterfall, a helicopter tour, and playing with elephants, I was out of cash. Unsurprisingly, my debit cards wouldn’t work at any ATMs. Worried that I wouldn’t make it back to the airport, I offered the driver payment in crypto from my phone, knowing I could send it as soon as I found Wi-Fi. However, his business wasn’t set up to accept digital currencies.

On faith, he took me across the border and safely to the airport, then waited days for me to send him payment – again, trusting a stranger on her word. My experience vividly highlighted the need for more agile and instantaneous cross-border solutions.

Yellow Card: Bridging the Cash Gap in Africa

My story is precisely where Yellow Card’s innovative platform could have instantly solved my predicament. As a leading pan-African stablecoin orchestrator, Yellow Card is designed to be an “on-ramp/off-ramp” for stablecoins across the continent, including Zambia. Even if the driver couldn’t directly accept crypto, I could have used the Yellow Card app to convert my USDC into local currency (Zambian Kwacha). From there, I could have instantly transferred the Kwacha directly to his mobile money account or bank account.

Yellow Card’s recent partnership with global payments giant Visa further revolutionizes this by allowing businesses to hold U.S. dollars in stablecoins and then leverage Yellow Card’s infrastructure to send stablecoin-backed transfers directly into local bank accounts or even card-linked accounts via Visa Direct. Their solution addresses critical pain points, such as high costs and slow speeds in traditional African cross-border transactions, by making payments available 24/7 and bypassing the reliance on physical ATMs or complex international wire transfers.

My experience shows how digital payment innovations like Yellow Card are not just theoretical; they are rapidly becoming essential solutions for everyday challenges in regions with evolving financial infrastructures.

(Source: CNBC Africa, “Yellow card, Visa partner to accelerate adoption across emerging economies,” June 19, 2025; TechCabal, “Yellow Card and Visa bring stablecoin payments to Africa,” June 19, 2025)

Partner & Product spotlight.

With lending, payments, cards, and capital management all under one roof, FinWise can offer Fintechs a proven platform to build, scale, and diversify their product stack:

FinWise Bank architected its Fintech offering around four key programs:

Lending Sponsorship |

Credit Enhancement |

|---|---|

|

Our Lending Sponsorship solution enables FinTech platforms to modernize the lending experience at scale, eliminating the need for multiple state licenses. FinWise works with Fintechs to build a lending product to be offered on their platform. Fintechs focus on what they know best: user experience, marketing, credit modeling while the Bank brings the Banking architecture needed to offer a lending product. By leveraging our API and embedded compliance, loans can be delivered faster with less confusion and more flexibility. Borrowers benefit from better accessibility, while FinTech partners receive the business and regulatory oversight to grow responsibly. This model supports a wide range of platforms from early-stage consumer lenders to established commercial lending providers. |

Designed to help lending and card receivables purchasers diversify funding sources while improving capital efficiency. Receivables purchasers benefit from access to lower-cost capital, extended funding beyond traditional warehouse lines, and yield sharing arrangements. Strategic programs receive a complete package for financing & sponsorship needs, including compliance and oversight processes.

|

BIN Sponsorship |

MoneyRails™ |

|

BIN Sponsorship allows Fintechs to issue cards by leveraging our direct access to the Visa and Mastercard networks, and our various partnerships with select processors and program managers. Our deep expertise in card programs enables Fintechs to quickly build and scale credit, debit, and prepaid offerings. We also provide regulatory guidance through a robust compliance and risk management framework. |

MoneyRails™ was developed as the solution for a modern payments hub system that will allow Fintechs and other businesses with high volume payment processing needs to safeguard deposits and process large numbers of payments via API. MoneyRails is meant to be a single home for ledgering, payment processing and Banking. Being highly modular and customizable, MoneyRails can seemingly adapt to any use-cases Fintechs want to support.

|

Plannery as a Standout Example

Plannery is a standout example of what’s possible when a FinTech fully leverages the breadth of FinWise’s FinTech infrastructure. What began as a single partnership through our Lending Sponsorship model has evolved into a dynamic, multi-pronged relationship that spans lending, payments, and capital.

Building a loan product

FinWise launched the Plannery salary-deduction personal loan product through our Lending Sponsorship model, using our proprietary APIs to power loan origination, underwriting, and compliance.

The unsecured, fixed rate, product allows hospital systems to offer their employees a simple solution to consolidate and reduce interest rates on credit card and personal loans. The product’s unique payroll-linked payment structure helps reduce missed payments and accelerate employees’ path to financial stability by providing access to financial services these healthcare professionals may not otherwise qualify for.

Plannery utilizes our APIs to transmit loan data, as collected as part of the Plannery user experience. Loan data is then automatically validated against defined underwriting rules. This allows Plannery and FinWise to scale with both speed and control.

How to grow a balance sheet?

As our forward flow partner, Plannery was looking to acquire some of the receivables FinWise originates. To further support their balance sheet and income growth, Plannery utilizes our Credit Enhanced Balance Sheet solution, enabling them to power loan growth while limiting the need for warehouse lines or outside capital. This structure helps address key challenges around capital efficiency and funding diversification. By tapping directly into our balance sheet, Plannery gains access to scalable funding capacity that drives growth.

Plannery is responsible for the servicing of FinWise’s Plannery loans.

Servicing salary-deduction loans is operationally complex and differs significantly from traditional servicing. In a traditional setup, lenders receive authorization to debit a borrower’s specific account, creating transparency and easy reconciliation by clearly linking payments to individual borrowers.

In contrast, salary-deduction servicing requires servicers to track incoming or pushed payments from borrowers, often tied to variable payroll schedules, ensuring every dollar is correctly matched to a loan account and reconciled. Without the right infrastructure, this can lead to delays, errors, and a lack of visibility regarding where funds are and whether they’ve been properly applied.

This is where MoneyRails comes in. Its built-in ledgering capabilities and sophisticated money movement tools simplify the entire process. All Plannery’s servicing payments are processed through MoneyRails, our embedded payments platform. For salary-deduction loans, this enables seamless servicing, with each borrower assigned a unique clearing account to streamline reconciliation and track funds in real time.

Plannery coordinates with each borrower’s payroll provider to update direct deposit instructions so that a portion of payroll is automatically deposited via ACH credit into the borrower’s designated clearing account for loan repayment. These funds are then automatically swept into a loan servicing deposit account where payments are remitted to receivable owners.

With the use of MoneyRail’s built-in tools, Plannery is able to manage servicing with precision and scale:

- Direct Subledgering (FinWise being the ledger of record for all subledgers) allows Plannery to open a unique clearing account for each loan account and creates a clear, auditable record of borrower-level activity, making it easy to reconcile payments

- ACH payments are deposited into this unique clearing account as borrowers receive their paychecks

- Once a deposit is received, Plannery relies on webhooks to notify them of incoming deposits, which triggers an automatic intrabank transfer to a sweep/payment collections account where funds are then reconciled further

- Should a deposit be more than a loan payment, Plannery relies on our Payment Endpoint to push money back to the borrowers’ checking accounts in real-time using ACH, RTP and FedNow

By bringing all this together on a single platform, MoneyRails powers a modern, reliable, and efficient experience for both Plannery and the borrower.

How to grow, period?

One of the biggest pain points for FinTechs, particularly lending platforms, is to figure out how to increase stickiness with a customer. The goal of lenders is never to trap customers in a cycle of debt – as such, FinWise and its FinTech Partners must get creative on how to deepen their penetration into customers’ wallets.

A way to achieve that goal and to further capitalize on customer acquisition costs could be to offer a card product to these already acquired and paid-for customers.

FinWise’s BIN Sponsorship program provides access to a network of experienced program managers who can assist with card issuance, network integration, and compliance oversight. This offering gives Fintechs a streamlined and compliant path to launch card products while accelerating time to market.

Industry recognition as a Top-Performing Bank.

Industry recognition for Top Innovation for MoneyRails.

Connect with us.

Upcoming 2025 Events

- September 3-4th, 2025 – U.S Faster Payments Council Member Meeting

- September 8-10th, 2025 – FinovateFall 2025

- September 30th, 2025 – AI Native Banking and Fintech Conference

- October 26-29th, 2025 – Money20/20 USA 2025

Join us on a FinWise Podcast found here:

|

|

|

|---|